Introduction

Breaking into new markets is a battle, and the key to success is understanding how people pay. Companies expanding globally often face an “activation barrier,” struggling to convert customers that: are comfortable with existing options, use adjacent products, or are wary of new digital offerings. Any additional friction to adoption (such as poor sign-up journeys, lack of relevant payment options, and poor product proposition adjustment) chokes the conversion funnel. When looking to expand, it is vital companies consider both existing consumer preferences (to capitalise on the mass market) as well as changing behaviours to position themselves for the preferences of tomorrow.

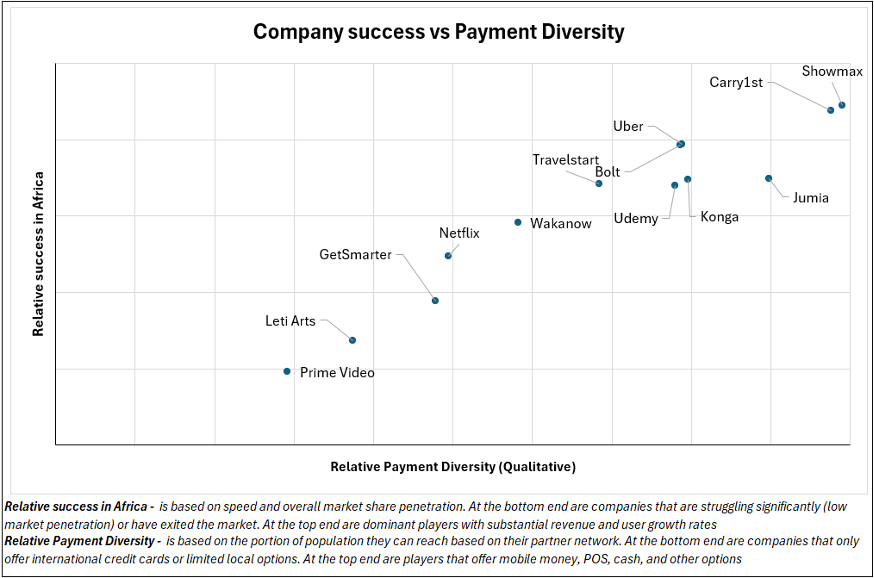

Consider Amazon’s recent foray into the Nigerian market with its Prime Video service. Despite its global dominance and vast resources, Amazon struggled to gain significant traction in the country, which boasts a population of over 200 million. While multiple factors likely contributed to this setback, a key issue was Amazon’s failure to adequately address local payment preferences. This oversight highlights the crucial role that payment diversity plays in overcoming the “activation barrier” and achieving success in new markets.

While Amazon stumbled, the local SVOD player Showmax took a dramatically different approach, tailoring its GTM strategy to embrace local consumer preferences. From expanding local content production, offering a diverse array of local payment options (partnering with POS partners such as Interswitch/Quickteller), launching a physical sales force to sell directly to the consumer, and partnering with leading telcos such as MTN, Showmax saw rapid growth over the same period that Amazon floundered.

Africa: Payment Complexity and the Power of Local Partnerships

Africa’s digital economy is booming, projected to rise from $180 billion in 2025 to $712 billion by 2050. With an internet penetration rate of around 37% as of 2023 and a mobile phone penetration rate of 80%+ in most African countries, the continent’s digital economy is poised for explosive growth.

But unlike the relatively homogenous payment landscapes of developed markets, Africa presents a mosaic of diverse payment methods. From the widespread adoption of mobile money to the continued reliance on cash, African consumers have distinct preferences shaped by infrastructure, culture, and financial inclusion. Prioritizing payment diversity and tailoring product propositions to local realities will separate the winners from the losers.

Uber first launched in South Africa in 2013, followed by Nigeria in 2014 and Kenya in 2015, accepting only credit cards on launch. Initially Uber saw very low traction in the markets before expanding payment options to include physical cash as well as mobile money (MPESA in Kenya) to mimic consumer behaviour. Following this change, Uber reported a three-fold increase in revenues in less than 6 months. A more modern example: As the digital services partner for one of the largest telcos in Africa, Mondia recently launched a highly popular yoga service which we have successfully scaled in some of the largest European operators. Initially, growth was slow; however, leveraging our African experience we recommended to the service provider that they launch a new “daily” version of the product. The product has since grown over ten-fold in less than 6 months, as it has become more accessible to a vast portion of the population.

Figure 1 illustrates that this is not a coincidence but rather a correlation. The more “local” a business is in its payment options (and product offering), the more successful it is in Africa

Global Markets: Adapting to the Evolving Payments Landscape

While Europe, Asia-Pacific, and North America boast a more mature digital payments landscape, businesses must navigate a more nuanced set of challenges and opportunities. Here, the core principle of aligning with customer preferences and minimizing friction still holds true, however, the rapid evolution of payment preferences requires a higher degree of product agility. To successfully expand in this environment, companies must adopt a route to market that is not just flexible, but also highly adaptable to these fast-moving trends.

The rapid increase in the variety of payment methods place (Buy Now, Pay Later (BNPL); mobile wallets; e-banking) illustrates that in more digital countries, it’s not apart WHO you partner with for payments, but rather WHAT type of payments you accept, and that this landscape is almost constantly evolving. Indeed Tamara, a fintech company that offers BNPL solutions that enable customers to subscribe to services previously out of reach, was Saudi Arabia’s first unicorn. To reach and convert the maximum number of customers, companies looking to expand into the GCC (and beyond) need to adhere to both traditional and growing payment options.

One of the key strengths of fintech is its ability to harness data for greater personalization. At Mondia, we’re enabling our partners to create customized subscription plans—whether it’s family plans, tiered pricing, or pay-per-use options to increase engagement and monetization. This level of personalization, combined with recurrent payment systems, reduces friction for our customers and significantly improves retention. By leveraging customer insights, we’re helping our content partners craft more compelling propositions at an individual level, enhancing the overall customer experience and enabling consumers to use their preferred payment method.

The Future of Payments: Embracing Innovation and Emerging Trends

Customer preferences around payments are broadening, with mobile wallets rapidly gaining ground. According to Juniper Research, DCB transactions are projected to grow from $28 billion in 2020 to $40 billion in 2025. However, the mobile wallet market, valued at $1 trillion in 2019, is expected to reach an astonishing $7.58 trillion by 2027, with a compound annual growth rate (CAGR) of 28.2%. This significant growth highlights the increasing consumer inclination toward more varied payment methods, such as mobile wallets and A2A (Account-to-Account) payments. Recent data from Boku’s 2024 Global E-commerce Report indicates that A2A payments will grow from 8% of e-commerce spending in 2023 to 16% by 2028, doubling their share of transaction volume globally. Similarly, BNPL options are steadily expanding, projected to grow their e-commerce value share from 4% in 2023 to 5% by 2028. These shifts underscore a move towards diversified and consumer-centric payment ecosystems, which increasingly favor flexible digital solutions.

Fintech is breaking new ground by enabling integration with previously untapped distribution channels. The range of fintech solutions available today is huge. Mobile wallets, such as Apple Pay and Google Wallet, and payment apps like PayPal, AliPay, WeChat, and M-Pesa, alongside various mobile carrier-branded wallets, have become crucial channels,especially in mobile-first markets and regions with low banking or credit card penetration. These solutions are breaking down barriers, allowing customers to access higher-value subscription services with ease.

Companies need to keep pace with these evolutions either by constantly developing their product or partnering with players that will keep them on the frontier of payment facilitation. At Mondia, we allow high-quality digital service providers to focus on their core product, by ensuring they are connected in with the regionally relevant payment and distribution options across the globe.

Conclusion

The digital landscape, particularly across Africa, the GCC, and Europe, is evolving at an unprecedented pace. While the specifics may differ, one principle remains constant: success in new markets hinges on understanding and adapting to local preferences. This is particularly true when it comes to payments. As this article has shown, the cost of neglecting payment diversity can be significant, hindering growth and even leading to market exits. Conversely, embracing a hyperlocal approach, prioritizing payment flexibility, and minimizing friction across the customer journey can unlock remarkable opportunities. The future belongs to those businesses that not only recognize the importance of payment diversity but also proactively build it into their expansion strategies.

Payment diversity and local relevance is not a “nice-to-have” – it is the key to unlocking sustainable growth.

What are your thoughts on the importance of payment diversity for successful global expansion and local penetration? Feel free to connect and discuss!

To learn about how Mondia supports digital payments and subscription models, see our Payments page.

About Mondia

Mondia Group is a leading mobile commerce company dedicated to connecting, digitalising and monetising mobile consumers. The Mondia Group provides access to over 700m consumers through more than 60 mobile operators across 30 countries. With offices across Europe, the Middle East and Africa, Mondia is committed to enabling digitalisation across the globe through its distinctive technology, strategic partnerships, extensive network and global coverage. Mondia also offers unparalleled reach to the world’s most recognised brands and merchants, ensuring secure, simplified, and seamless global Direct Carrier Billing (DCB), Local Payment Methods, and digital payment solutions.

About the Author

Nathan Hanley, Chief Commercial Officer at Mondia, is a seasoned leader in the Technology, Media, and Telecommunications (TMT) industry with over 13 years of expertise in corporate strategy, business transformation, and scaling ventures across diverse sectors like digital media, fintech, AI, and telecommunications. As Chief Commercial Officer, Nathan leads Mondia’s global commercial strategy, overseeing business development, partnerships, and revenue generation. With a deep understanding of the fintech industry, Nathan is instrumental in driving innovation and growth. Nathan is a strategic thinker with a proven ability to identify and capitalize on emerging opportunities.

Sources:

Africa’s digital economy. (2023, October 25). Digital Realty.

The Mobile Economy Sub-Saharan Africa 2022. (2022, October). GSMA Intelligence.

Africa’s digital economy to reach $712bn by 2050 – CNBC Africa

Africa’s Digital Transformation | Accenture

As it expands in Africa, Uber adapts to local markets and adopts cash payments | TechCrunch

https://www.juniperresearch.com/press/digital-wallet-users-exceed-5bn-globally-2026

https://www.statista.com/topics/4872/mobile-payments-worldwide